Introduction: A New Era for Financial Engagement

For decades, banks and fintechs relied on face-to-face interactions and static communication. A customer walked into a branch, sat across from an advisor, and received service tailored to their immediate need.

Today, customer interactions rarely happen in one place. They’re fragmented across apps, emails, SMS, social feeds, and call centers. But expectations haven’t changed. People still want the trust and personalization of a branch visit, only now they demand it way faster.

Customers want fast and personalized service on every channel, but they also want to feel valued and understood. Banks can achieve this by bringing AI and omnichannel engagement together—a winning combination for building trust and lasting relationships.

Why Omnichannel Is No Longer Optional in Finance

In the world of fintech and banking, customer journeys are inherently complex. From opening an account to applying for loans to managing investments, clients often jump between digital and offline channels.

An omnichannel approach ensures that these touchpoints connect seamlessly:

- A customer starts a mortgage application online, pauses midway, and later receives a personalized reminder via email.

- A fraud alert sent via SMS links directly to an in-app confirmation page, eliminating friction.

- A client browsing investment tips on social media receives contextual advice when they log back into their banking app.

Without omnichannel, these moments feel disjointed. With it, financial institutions can build trust through consistency—a currency more valuable than ever in the sector.

How AI Supercharges Omnichannel Banking Experiences

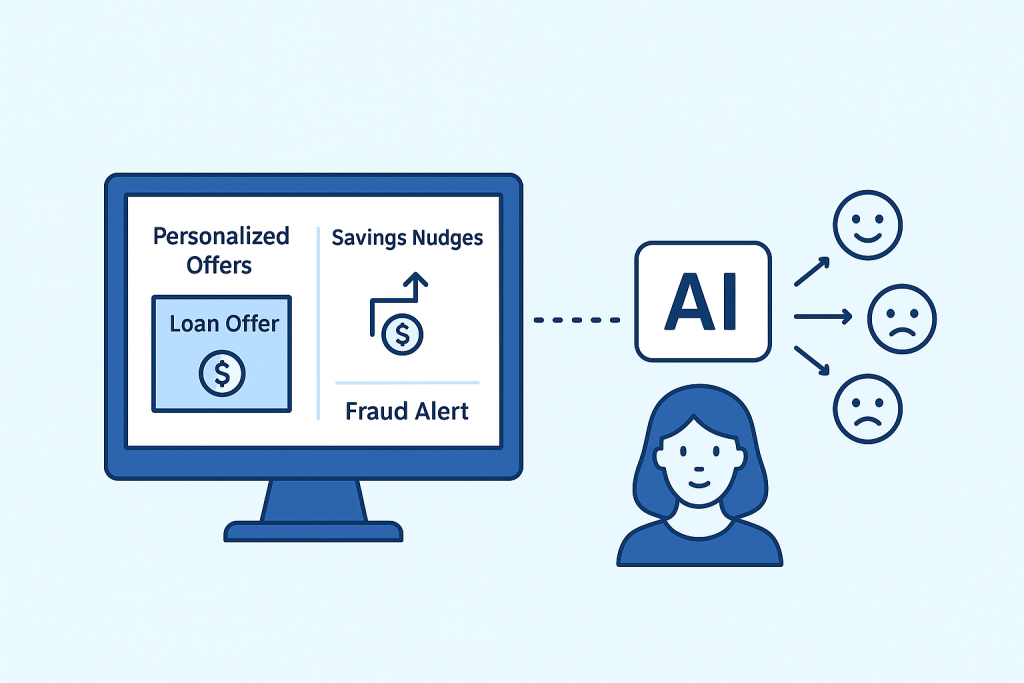

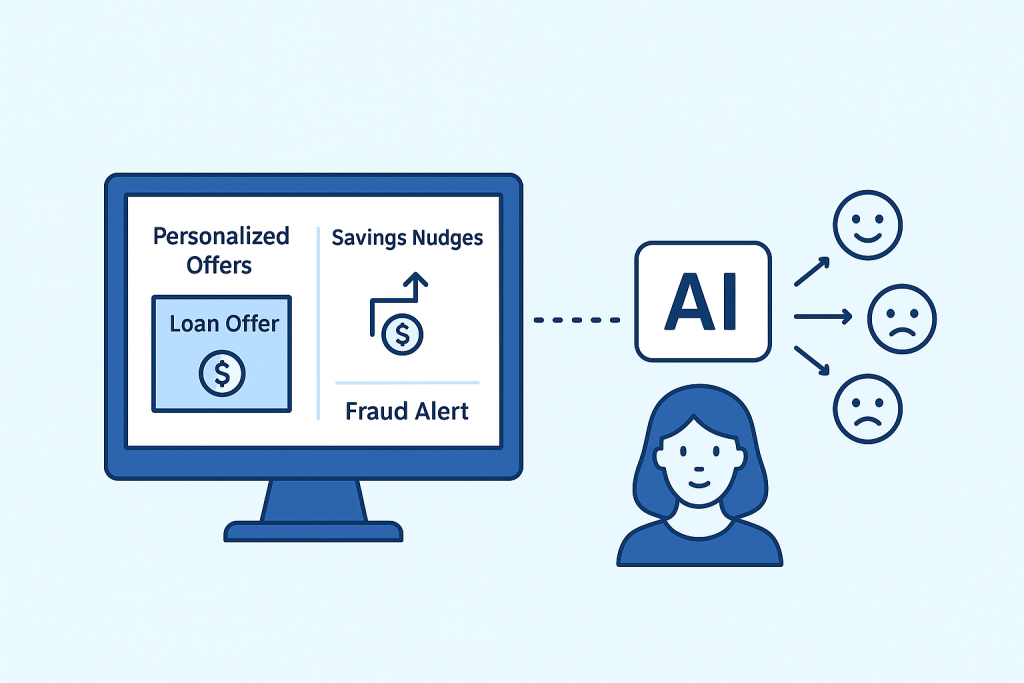

While omnichannel lays the foundation, AI provides the intelligence that turns interactions into relationships. In the fintech and banking space, AI-driven engagement delivers three critical advantages:

Hyper-Personalization at Scale

Customers are no longer satisfied with blanket promotions like “Get a personal loan today.” AI tools analyze transaction history, browsing behavior, and even sentiment to deliver contextual, one-to-one offers:

- A student scrolling through tuition transactions may receive an AI-suggested low-interest education loan.

- A client building savings gets tailored nudges toward a relevant high-yield account.

Smart Automation for Timely Touchpoints

AI-driven automation ensures no opportunity is missed. For example:

- An abandoned credit card application triggers a timely email followed by a helpful chatbot interaction.

- A customer traveling abroad receives an automated but personalized alert about activating international card usage.

Real-Time Insights & Sentiment Analysis

Financial trust hinges on understanding emotions as much as actions. Modern engagement platforms can analyze customer sentiment in real time—through call transcripts, chat conversations, and social interactions.

- Detecting frustration in a support chat could trigger an immediate escalation to a human advisor.

- Positive sentiment after a successful loan approval could prompt a well-timed loyalty message.

This combination transforms customer engagement from reactive service into proactive relationship-building.

Join our upcoming webinar, “Redefining Customer Engagement with AI & Omnichannel Strategy.”

Turning Strategy into Measurable Banking Results

The promise of AI + omnichannel isn’t theoretical; it’s tangible. Leading engagement platforms today offer a blend of capabilities tailored for financial institutions, including:

- Omnichannel Orchestration: Unifying email, SMS, app notifications, and chat into one consistent flow.

- AI-Powered Personalization: Tailoring credit, savings, and investment recommendations in real time.

- Sentiment Intelligence: Monitoring tone and mood across interactions to build empathy into digital engagement.

- Data-Driven Insights: Turning vast transaction and engagement data into actionable strategies.

- Scalability: Supporting millions of interactions daily without compromising relevance or compliance.

For banks and fintechs, the benefits are measurable:

- Higher customer retention through personalized financial journeys.

- Increased conversion rates on loans, cards, and investment products.

- Reduced operational inefficiencies thanks to intelligent automation.

The Future of Customer Engagement in Banking

As financial services continue their digital evolution, one truth is clear: the winners will be those who merge empathy with intelligence.

Customers don’t just want faster service; they want service that understands them. They don’t just want more offers; they want the right offer, delivered in the right channel, at the right moment.

By combining AI’s predictive power with omnichannel’s connected experience, banks and fintechs can deliver exactly that.

The future of customer engagement isn’t about replacing the human touch; it’s about scaling it with intelligence.

Ready to Take the Next Step?

If your financial institution is exploring how to bring AI and omnichannel strategies together, our experts can help. From personalization and sentiment analysis to automation and customer journey design, we’ll work with you to identify opportunities tailored to your business.

Request your expert consultation today and start redefining how you engage with customers.

Join our upcoming webinar, “Redefining Customer Engagement with AI & Omnichannel Strategy,” to explore how forward-thinking financial brands are leading this shift and how you can apply these strategies to build deeper, more profitable customer relationships.